Starting your own business doesn't have to be a daunting task for physicians wanting to go solo. With the right planning, guidance, and resources, it is possible to start a new practice, either from training or leaving a Foundation/Hospital/Single or Multi-specialty group.

The Business Master Class to Setting Up Your Private-Practice

Sep 20, 2019 3:24:07 PM / by ACap Advisors & Accountants posted in healthcare, Webinar, medical

Retirement Advisors - Getting Started

Sep 12, 2019 3:48:06 PM / by Ara Oghoorian posted in Retirement, Business, saving, Saving, 401(k), Blog, Financial Planning, Investing

In retirement saving, as with many other forms of long term financial planning, understanding and mapping out what portion of your financial profile will be devoted to your savings is crucial. Although different savers have different needs and different levels of understanding of how this long-term planning should go, it’s always useful to enlist the aid of a financial advisor (or, as it pertains to retirement savings, a retirement advisor), who can provide individualized guidance and input on how this process should go. Selecting an advisor who will fulfill your needs and help you meet your retirement goals can help you make a big step towards your future, so considering your circumstances and the services offered by the retirement advisor is imperative.

ACap ReCap: Estimated Tax Payments

Aug 28, 2019 1:34:25 PM / by ACap Advisors & Accountants posted in Taxes, tax deduction, Video, tax-planning

In each episode of the ACap ReCap, we go beyond the blog to answer your financial questions. Ara & Matt explain if you should be paying estimated tax payments based on your income source, when to make those payments to the IRS, and the important tax planning information you need to know.

Los Angeles City Business Tax Explained

Aug 23, 2019 10:17:06 AM / by ACap Advisors & Accountants posted in Webinar

Do you operate a business within the City of Los Angeles? Did you know that you must have a business license and pay an annual tax?

ACap ReCap: Should I Pay Off My Mortgage?

Aug 7, 2019 6:08:17 PM / by ACap Advisors & Accountants posted in interest rate, mortgage, homeownership, investment, Video

In each episode of the ACap ReCap, we go beyond the blog to answer your financial questions. Ara & Matt explain what to consider when deciding whether to pay off your mortgage.

IRS Releases New Tax Forms

Aug 5, 2019 12:41:14 PM / by ACap Advisors & Accountants posted in Taxpayers, IRS, Taxes, Blog, tax-planning

Just as we are starting to comprehend the Tax Cuts and Jobs Act, the IRS might be adding some new tax forms to use in 2019. Earlier this month, the IRS released several new draft tax forms for 2019. While the list of draft forms was long, the most notable forms are the 1040 and a new 1040-SR for seniors age 65 or older.

Roth IRA or Traditional IRA- Which to Choose?

Aug 4, 2019 2:35:41 PM / by Ara Oghoorian posted in investments, Traditional IRA, saving, Saving, Roth IRA, Blog, IRA, Investing

Saving for retirement often requires the structure of long-term planning: strategies that will allow you to make the most of your savings while utilizing tax advantages. This kind of framework is taken care of by IRAs, or Individual Retirement Accounts. An IRA is a form of retirement plan that provides tax advantages for retirement savings, giving savers the economic benefits that will allow them to reach their saving goals efficiently.

CPA Roundtable: Opportunity Zones Explained

Jul 16, 2019 11:26:47 AM / by ACap Advisors & Accountants posted in Webinar, Taxes, opportunity zones, Investing

Location, Location, Location--the most important factor in real-estate investing can help you qualify for a generous tax break. In our first CPA Roundtable discussion, ACap's Ara Oghoorian is joined by Andrew Barnett of Boroda Holm, and Steve Post of Weiss Accountancy, to discuss the basics behind Opportunity Zones, their tax implications, and how they impact real estate opportunities for business owners.

Restricted Stock Units (RSUs) Decoded

Jul 15, 2019 2:29:54 AM / by Matt Crisafulli posted in stocks, 401(k), Taxes, Blog, compensation, benefits

In today’s competitive job market, where the top companies are competing for the top talent, employers use every tool at their disposal to attract and retain the best of the best. More and more often, these compensation packages go way beyond salary and factor in other employee benefits, such as top of the line health insurance plans, a 401(k) plan with a company match, and for those in the more senior roles, shares of company stock in the form of Restricted Stock Units.

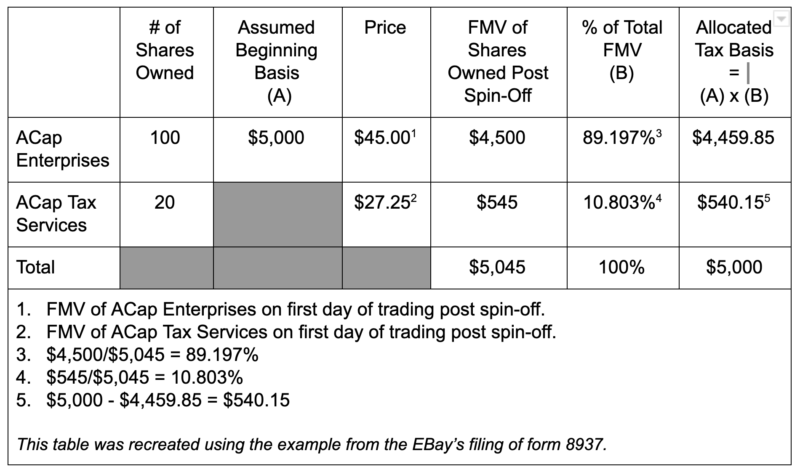

What is the difference between Spin-Off, Split-Off, and Split-Up?

Jul 10, 2019 11:37:54 AM / by Ara Oghoorian posted in Blog

It is not uncommon for corporations to own stock in other corporations. The ownership could be either through acquisitions or the creation of a new corporation by the parent company. Sometimes, for a variety of reasons, the parent company wants to separate their ownership in the subsidiary corporation, most of the time it’s because the subsidiary is in an unrelated business from the parent or has more growth prospects as a separate company. That separation from the parent corporation can be either through a spin-off, split-off, split-up, carve-out, or simply a sale of the subsidiary. This article will focus on the first three and briefly discuss a carve-out; a sale of a corporation is straightforward and will not be covered.

%20Final%20copy%202-1.jpg?width=952&height=355&name=ACapA-A(Color)%20Final%20copy%202-1.jpg)