What is the Dow Jones Industrial Average?

What is the Dow Jones Industrial Average (DJIA)?

Nov 16, 2020 8:33:18 AM / by Ara Oghoorian posted in stock market, ETF, stock split, Retirement, Honeywell, Exxon, NASDAQ, investing, Saving, ACap Asset Management, Your Money, Fiduciary, S&P 500, Amgen, Fee-Only, Dow Jones Industrial Average (DJIA), Investing, Raytheon, Pfizer, Salesforce, ACap Advisors & Accountants, General Electric, Vanguard

What is a trust and do I need one

Oct 18, 2020 1:57:54 PM / by Ara Oghoorian posted in Power of Attorney, Probate, Revocable Trust, Trustee, Taxes, Fiduciary, Estate Planning, Wills

As a financial advisor and CPA, one of the top questions I receive are “what is a trust” and “do I need a trust?” There are a so many different types of trust (i.e. GRAT, CLAT, ILIT, GST, revocable, irrevocable, charitable, asset protection, the list goes on and on), but in this article we are only going to cover the revocable living trust (aka: inter vivos trust) because that is the most common. The main reason why people create trusts is to avoid probate, but a trust has many other benefits.

How to Avoid Probate

Oct 17, 2020 1:57:21 PM / by Ara Oghoorian posted in Trusts, Taxes, Fiduciary, Estate Planning, Fee-Only, Capital Gains

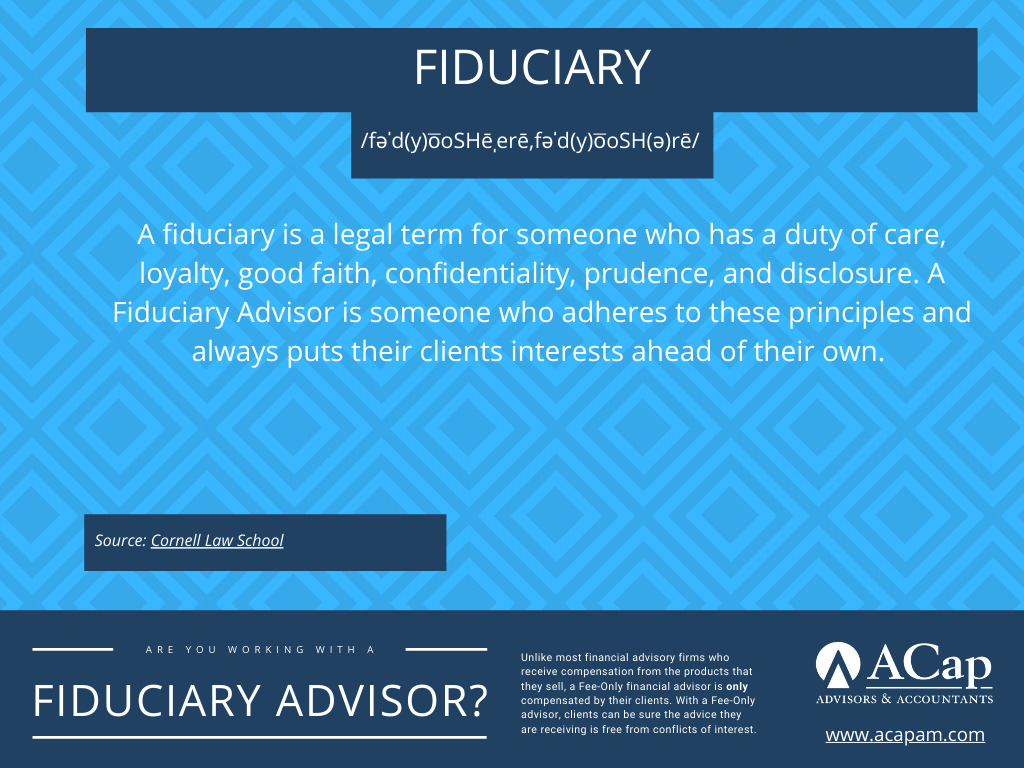

What is a Fiduciary Financial Advisor

Sep 7, 2020 11:43:03 AM / by Ara Oghoorian posted in Fiduciary, Fee-Only, Blog

A fiduciary financial advisor is independent and someone who puts your (the client) interests ahead of their own at all times. The true definition of a fiduciary is someone “held or founded in trust or confidence.” And according to the Cornell School of Law, a person with a fiduciary duty is held to a higher standard and has a duty of care, loyalty, good faith, confidence, prudence, and disclosure. All of these combined ensure that a fiduciary financial advisor will always work in your best interest and not have any conflicts of interest. Should your financial advisor be a fiduciary? The answer is yes! When searching for a financial advisor, always make sure they are acting in a fiduciary capacity and not in a suitability capacity, which is significantly less stringent. Insurance companies and investment banks act in a suitability standard whereas a Registered Investment Advisor (RIA) is held to a fiduciary standard.

%20Final%20copy%202-1.jpg?width=952&height=355&name=ACapA-A(Color)%20Final%20copy%202-1.jpg)