On August 8, 2020, President Trump signed a presidential memorandum, allowing employers to defer deducting payroll taxes from employee paychecks from September 1, 2020 through December 31, 2020. The memorandum offered little guidance beyond the fact that it is only eligible for employees making less than $4,000 per bi-weekly pay period, or the equivalent amount for different pay schedules.

Matt Crisafulli

Recent Posts

What is the Trump Payroll Tax Deferral and Who is Eligible?

Sep 12, 2020 6:50:57 AM / by Matt Crisafulli posted in IRS, Taxes, payroll

How does the SECURE Act affect RMDs?

Aug 25, 2020 5:15:04 AM / by Matt Crisafulli posted in IRS, Taxes

What is a Required Minimum Distribution (RMD)

Aug 24, 2020 5:09:11 AM / by Matt Crisafulli posted in IRS, RMD, Taxes

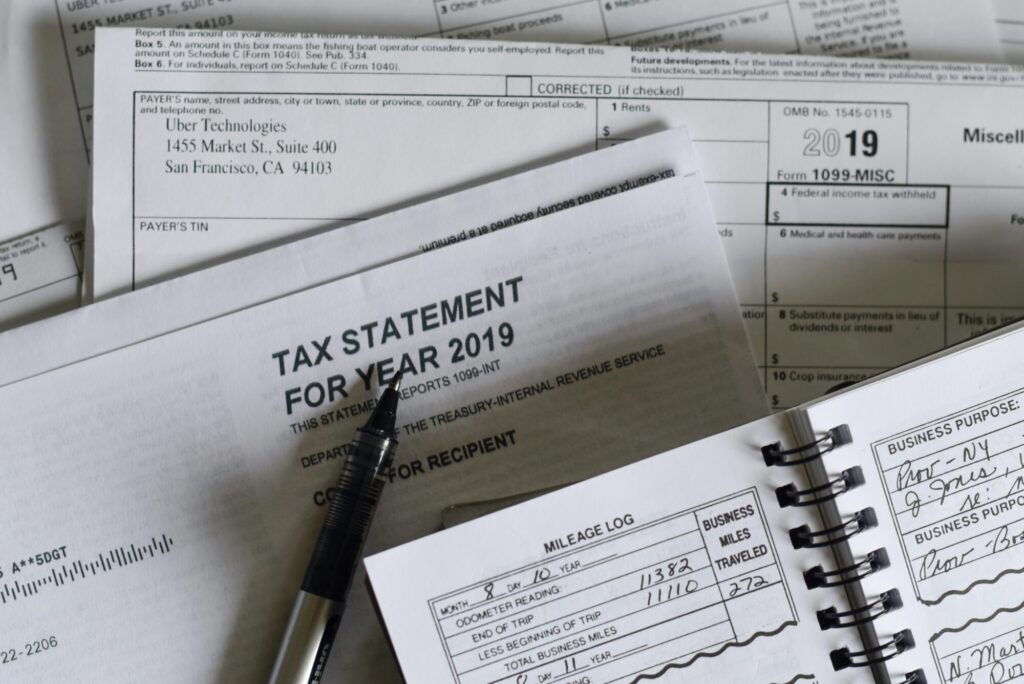

By Matt Crisafulli, CFP, EA, August 24, 2020

CARES Act (COVID-19 Economic Relief)

Apr 8, 2020 10:57:27 AM / by Matt Crisafulli posted in Blog

Matt Crisafulli’s webinar on the CARES Act:

Restricted Stock Units (RSUs) Decoded

Jul 15, 2019 2:29:54 AM / by Matt Crisafulli posted in stocks, 401(k), Taxes, Blog, compensation, benefits

In today’s competitive job market, where the top companies are competing for the top talent, employers use every tool at their disposal to attract and retain the best of the best. More and more often, these compensation packages go way beyond salary and factor in other employee benefits, such as top of the line health insurance plans, a 401(k) plan with a company match, and for those in the more senior roles, shares of company stock in the form of Restricted Stock Units.

What Market Volatility Can Teach You about Your Risk Tolerance

Jan 24, 2019 10:21:45 AM / by Matt Crisafulli posted in finance, stock market, volatility, stocks, Risk, Blog

Markets have been extremely volatile in the last few months, and while it’s true that volatility is normal and even healthy, it doesn’t necessarily mean it is a welcome occurrence for everyone. However, that unpredictability can be used as a tool to help you evaluate your true risk tolerance to prepare yourself and your portfolio going forward.

A Gift from the Internal Revenue Service

Jan 18, 2019 8:57:56 AM / by Matt Crisafulli posted in Taxpayers, IRS, Taxes, Blog

This week, a lot of Americans received a gift from the Federal Government, as the IRS announced that it will waive the estimated tax penalties for those who underwithheld taxes in 2018. There are some limitations to this gift, but such a waiver could end up saving Americans a lot of money in additional tax penalties.

The Guide to Required Minimum Distributions (RMD)

Dec 19, 2018 2:09:55 PM / by Matt Crisafulli posted in 401k 403b, SEP IRA, Retirement, RMD, assets, Blog, Financial Planning, IRA

The end of the year marks an important deadline for those who have been accumulating assets in a retirement account. That is because the majority of those who are over the age of 70.5 must take a required minimum distribution (RMD for short) from their retirement accounts before December 31st of each year. However, there are a number of caveats to this requirement, because it wouldn't be an IRS rule if there weren’t exceptions and exemptions.

How Financial Plans Differ From Budgets

Nov 26, 2018 11:18:38 AM / by Matt Crisafulli posted in Blog, Financial Planning

We get a lot of questions on what is involved in creating a client’s financial plan, and the one clarification we always have to make is that a financial plan is not a budget. While it is true that cash flow is an integral part of any person’s overall financial well-being, that is not an area where we can add value, nor can we really analyze what an appropriate amount is for someone to spend in any particular category.

5 Easy Ways to Save Money on Golf

Nov 20, 2018 11:31:53 AM / by Matt Crisafulli posted in Blog

Golfing is my favorite way to pass time and destress. But it is also one of the more expensive sports you can play as a casual weekend hobby. Golf clubs, golf balls, driving range practice, green fees, cart fees...then, to see progress in your game, you will probably need to take lessons. At the very least, you will need to spend a lot of time and money playing and practicing to see any improvement at all. The list of items you can spend money on when it comes to playing golf is endless.

%20Final%20copy%202-1.jpg?width=952&height=355&name=ACapA-A(Color)%20Final%20copy%202-1.jpg)