Student Loans Payments Paused Again

Ara Oghoorian

Recent Posts

More Time to Pay Your Student Loans

Dec 8, 2020 12:59:58 PM / by Ara Oghoorian posted in Retirement, Department of Education, Taxes, Your Money, Student Loans

What is the Dow Jones Industrial Average (DJIA)?

Nov 16, 2020 8:33:18 AM / by Ara Oghoorian posted in stock market, ETF, stock split, Retirement, Honeywell, Exxon, NASDAQ, investing, Saving, ACap Asset Management, Your Money, Fiduciary, S&P 500, Amgen, Fee-Only, Dow Jones Industrial Average (DJIA), Investing, Raytheon, Pfizer, Salesforce, ACap Advisors & Accountants, General Electric, Vanguard

What is the Dow Jones Industrial Average?

What is a trust and do I need one

Oct 18, 2020 1:57:54 PM / by Ara Oghoorian posted in Power of Attorney, Probate, Revocable Trust, Trustee, Taxes, Fiduciary, Estate Planning, Wills

As a financial advisor and CPA, one of the top questions I receive are “what is a trust” and “do I need a trust?” There are a so many different types of trust (i.e. GRAT, CLAT, ILIT, GST, revocable, irrevocable, charitable, asset protection, the list goes on and on), but in this article we are only going to cover the revocable living trust (aka: inter vivos trust) because that is the most common. The main reason why people create trusts is to avoid probate, but a trust has many other benefits.

How to Avoid Probate

Oct 17, 2020 1:57:21 PM / by Ara Oghoorian posted in Trusts, Taxes, Fiduciary, Estate Planning, Fee-Only, Capital Gains

Will the elections affect the stock market?

Oct 10, 2020 1:11:36 PM / by Ara Oghoorian posted in Facebook, stocks, Congress, Harris, elections, ACap News, Apple, Amazon, Microsoft, Trump, Google, Taxes, Your Money, Blog, Biden, Investing, Pence

The question on investor’s minds is how will the markets react to the elections next month and will a contested election result in more volatility? We have already seen much volatility in the markets with large daily swings. Most experienced investors feel that markets are overvalued and don’t reflect economic conditions. We believe that in the near-term (5 years or less), markets will remain volatile and that some sectors are overvalued while others are undervalued. These volatile days/weeks create buying opportunities because in the long-term, we believe that stocks are the best investment to save for retirement and to beat inflation.

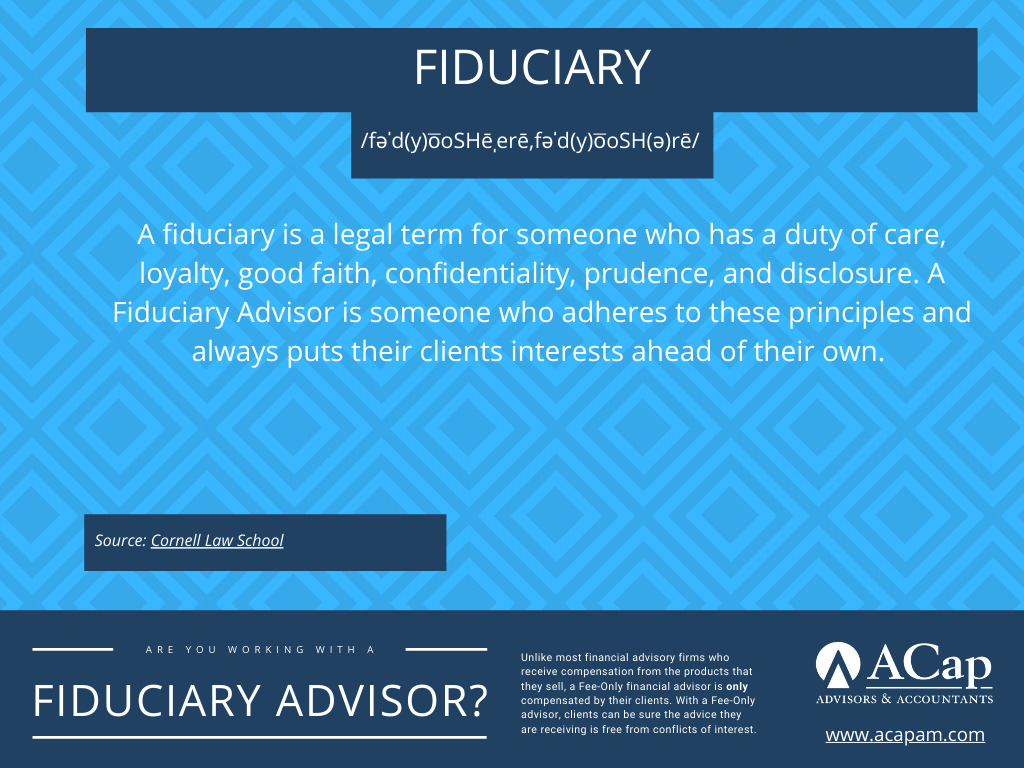

What is a Fiduciary Financial Advisor

Sep 7, 2020 11:43:03 AM / by Ara Oghoorian posted in Fiduciary, Fee-Only, Blog

A fiduciary financial advisor is independent and someone who puts your (the client) interests ahead of their own at all times. The true definition of a fiduciary is someone “held or founded in trust or confidence.” And according to the Cornell School of Law, a person with a fiduciary duty is held to a higher standard and has a duty of care, loyalty, good faith, confidence, prudence, and disclosure. All of these combined ensure that a fiduciary financial advisor will always work in your best interest and not have any conflicts of interest. Should your financial advisor be a fiduciary? The answer is yes! When searching for a financial advisor, always make sure they are acting in a fiduciary capacity and not in a suitability capacity, which is significantly less stringent. Insurance companies and investment banks act in a suitability standard whereas a Registered Investment Advisor (RIA) is held to a fiduciary standard.

What is the difference between Spin-Off, Split-Off, Split-Up, and Carve-Out?

Aug 15, 2020 12:11:36 PM / by Ara Oghoorian posted in stocks, spin-off, General, split-off, Blog, split-up, carve-out, Investing

It is not uncommon for corporations to own stock in other corporations. The ownership could be either through an acquisition or the creation of a new corporation by the parent company. Sometimes, for various reasons, the parent company wants to separate their ownership in the subsidiary corporation, most of the time it’s because the subsidiary is in an unrelated business from the parent or the subsidiary has more growth prospects as a separate company from the parent. That separation from the parent corporation can be either through a spin-off, split-off, split-up, carve-out, or simply a sale of the subsidiary. This article will focus on the first three and briefly discuss a carve-out; a sale of a corporation is straightforward and will not be covered.

What's a stock split and how does it impact cost basis?

Aug 11, 2020 4:37:08 PM / by Ara Oghoorian posted in stock split, Apple, Amazon, Starbucks, Blog, COVID-19, financial advice

2020 Home Office Deduction: FAQ

Aug 8, 2020 3:48:28 PM / by Ara Oghoorian posted in IRS, Home Office Deduction, Taxes, Blog

Chances are you're either working from home full-time or a few days a week due to COVID-19. Naturally, you may be wondering if you can claim a home office deduction when you file your 2020 tax return. Additionally, you may be wondering what expenses you can deduct and how much. This article covers some of the most common questions related to claiming the home office deduction and deciding which one is right for you.

What is the SBA Disaster Loans program?

%20Final%20copy%202-1.jpg?width=952&height=355&name=ACapA-A(Color)%20Final%20copy%202-1.jpg)