From debt payment to investments to long-term saving, getting the help of a financial advisor to address your financial profile can allow you to target a course of action to fulfill your needs and help you make significant progress towards achieving your financial goals. A financial advisor is a professional who offers guidance and services specific to the financial circumstances of their clients. This means that regardless of your financial needs or situation, a financial advisor will help work with you individually on your own financial profile.

Ara Oghoorian

Recent Posts

How to Pick the Right Financial Advisor

Oct 14, 2019 12:05:25 PM / by Ara Oghoorian posted in Retirement, Business, saving, Saving, 401(k), Blog, Retirement Plan, Financial Planning, Investing

Retirement Advisors - Getting Started

Sep 12, 2019 3:48:06 PM / by Ara Oghoorian posted in Retirement, Business, saving, Saving, 401(k), Blog, Financial Planning, Investing

In retirement saving, as with many other forms of long term financial planning, understanding and mapping out what portion of your financial profile will be devoted to your savings is crucial. Although different savers have different needs and different levels of understanding of how this long-term planning should go, it’s always useful to enlist the aid of a financial advisor (or, as it pertains to retirement savings, a retirement advisor), who can provide individualized guidance and input on how this process should go. Selecting an advisor who will fulfill your needs and help you meet your retirement goals can help you make a big step towards your future, so considering your circumstances and the services offered by the retirement advisor is imperative.

Roth IRA or Traditional IRA- Which to Choose?

Aug 4, 2019 2:35:41 PM / by Ara Oghoorian posted in investments, Traditional IRA, saving, Saving, Roth IRA, Blog, IRA, Investing

Saving for retirement often requires the structure of long-term planning: strategies that will allow you to make the most of your savings while utilizing tax advantages. This kind of framework is taken care of by IRAs, or Individual Retirement Accounts. An IRA is a form of retirement plan that provides tax advantages for retirement savings, giving savers the economic benefits that will allow them to reach their saving goals efficiently.

What is the difference between Spin-Off, Split-Off, and Split-Up?

Jul 10, 2019 11:37:54 AM / by Ara Oghoorian posted in Blog

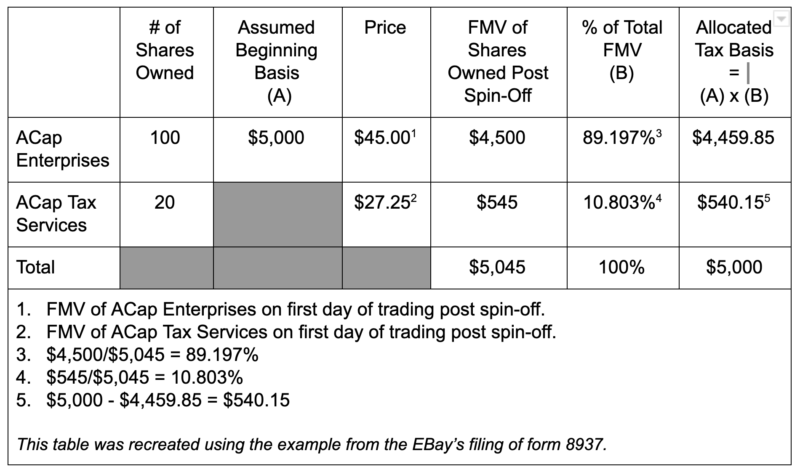

It is not uncommon for corporations to own stock in other corporations. The ownership could be either through acquisitions or the creation of a new corporation by the parent company. Sometimes, for a variety of reasons, the parent company wants to separate their ownership in the subsidiary corporation, most of the time it’s because the subsidiary is in an unrelated business from the parent or has more growth prospects as a separate company. That separation from the parent corporation can be either through a spin-off, split-off, split-up, carve-out, or simply a sale of the subsidiary. This article will focus on the first three and briefly discuss a carve-out; a sale of a corporation is straightforward and will not be covered.

Accounting Takeaways from AICPA Conference

Jun 17, 2019 4:54:05 PM / by Ara Oghoorian posted in wealth management, accounting, aicpa, conference, Blog, Financial Planning, accounting services

Financial markets and tax rules are changing constantly so staying current on such changes is critical to providing value for our clients. As a result, I recently attended a tax and financial planning conference in Las Vegas, NV by the American Institute of Certified Public Accountants (AICPA), which is the largest association representing the accounting profession. With over 4,000 attendees and over 100 individual sessions, there was no shortage of things to learn. As an added bonus, I heard several keynote speeches from notable leaders such as: Charles Rettig, Commissioner of the IRS; Simon Sinek, Optimist and Author; and NFL legend John Elway. Here are some key takeaways I gleaned from the conference.

How to Predict a Recession Before It Happens

Jun 5, 2019 12:04:09 PM / by Ara Oghoorian posted in stock market, stocks, GDP, recession, Blog, unemployment, economy

With the stock market hitting all time highs each day, investors are wondering if a recession is imminent. Some predict a recession is going to happen in 2020 while others think a recession will occur before year-end 2019. First, let’s define what a recession is and what it is not. By definition, a recession is two consecutive quarters of negative GDP (Gross Domestic Product). A recession is not a sharp decline in the stock market or consecutive months of negative returns in the stock market. The stock market is only one of many leading economic indicators. So how can we spot the next recession before it happens and protect our portfolios? The short answer is you cannot predict the market or the economy, but you can monitor key economic indicators to see where we are in the business cycle. The business cycle is the natural progression of the economy and consists of four phases: expansion, peak, recession, and recovery. Knowing where we are in the business cycle helps us make informed investment and business decisions. Below are explanations of each phase in the cycle in their order of occurrence.

Last-Minute Tax Tips for Doctors

Apr 1, 2019 9:17:01 AM / by Ara Oghoorian posted in Blog

2018 may be over, but there are still last-minute opportunities to manage and minimize your tax liabilities before the filing deadline, especially for self-employed doctors who are business owners.

Mutual Funds versus ETFs: Which One is Better?

Jan 29, 2019 11:14:00 AM / by Ara Oghoorian posted in liquidity, investments, stocks, Taxes, Blog, mutual funds

In recent years, more and more investors are selecting Exchange Traded Funds (ETFs) over mutual funds. But what exactly is an ETF, and how do they differ from the traditional mutual fund? Modern Portfolio Theory (invented by Nobel laureate Harry Markowitz) states that in order to minimize risk, investors should hold a portfolio of many uncorrelated (unrelated) stocks, similar to the expression “don’t put all of your eggs in one basket.” The problem with MPT is that the average investor would need a lot of money and time to create such a diversified portfolio. Mutual funds and ETFs solve this limitation by allowing investors to gain immediate diversification by combining their funds together.

Does Rental Real Estate Qualify for Section 199A QBI Deduction?

Jan 22, 2019 1:48:18 PM / by Ara Oghoorian posted in Taxpayers, IRS, Tax Deductions, Property, Business, Taxes, Blog

With the passage of the Tax Cuts and Jobs Act (TCJA) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199A deduction against Qualified Business Income (QBI). The answer is it’s not 100 percent clear, but the general consensus among tax practitioners is that income from rental properties will be deemed QBI and qualify for the deduction. Of course, there are always exceptions. The new section 199A deduction is limited to QBI generated from a qualified trade or business within the United States. Real estate ownership and its associated rental income is generally considered to be a passive activity. Therefore, the question is, if you own rental real estate, are you operating a trade or business to benefit from the deduction or are you just a passive investor?

City of Los Angeles Business Tax

Jan 16, 2019 12:50:50 PM / by Ara Oghoorian posted in finance, BTRC, Business, business license, Taxes, Blog, property tax

Are you a business owner who recently received a letter from the City of Los Angeles claiming you owe tax on your total revenues? If you operate a business within the City of Los Angeles, you must file a Business Tax-Registration Certificate (BTRC) each year regardless of whether or not you generated any revenues. The tax is due on the gross receipts of your business, which is the total revenues you collected before deducting any expenses. City of Los Angeles Business tax postcards were recently mailed and the business tax is due on February 28th of each year (29th if it’s a leap year). This tax is in addition to sales tax, state income tax, and the unsecured property tax imposed by the County of Los Angeles.

%20Final%20copy%202-1.jpg?width=952&height=355&name=ACapA-A(Color)%20Final%20copy%202-1.jpg)